“Bitfinex Cryptocurrency Trading Signal and Limit Order Market Review: A Deep Dive into Cryptocurrency Trading Opportunities with a Limit Order Approach”

In today’s fast-paced cryptocurrency market, traders are constantly looking for new ways to maximize their profits while minimizing their losses. Among the various trading strategies and tools available, one approach that has received significant attention in recent years is the use of limit orders on platforms like Bitfinex.

What is a limit order?

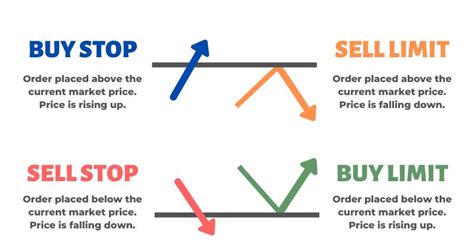

A limit order is an automatic buy or sell signal sent to a trading platform at a specific price level. It allows traders to set specific parameters for their trades, such as the minimum and maximum price at which they are willing to enter or exit a position. This type of order can only be executed if the conditions specified in the order are met.

Bitfinex Crypto Trading Signal

Bitfinex is one of the largest and most popular cryptocurrency exchanges in the world, offering a wide range of trading pairs, liquidity pools, and innovative features. The platform’s crypto trading signal system allows traders to set limit orders based on various market conditions and indicators.

Some of the key factors that contribute to Bitfinex’s crypto trading signal system are:

- Technical Indicators: Traders can set limit orders using technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands.

- News and Events: Traders can also use news and event-based signals to set limit orders, taking into account factors such as economic indicators, corporate announcements, and market sentiment.

- Sentiment Analysis: Bitfinex’s crypto trading signals system includes sentiment analysis tools that provide traders with buy or sell signals based on market sentiment.

Limit Order Market Review

Limit orders are a powerful tool for traders to execute trades at specific price levels, allowing them to lock in profits or limit their losses. When used properly, limit orders can be extremely effective in a crypto trading signals system.

Here’s how limit orders work with Bitfinex:

- Price Setting:

Traders use technical indicators and sentiment analysis tools to determine the price level.

- Trade Execution: The trade is executed when the specified price condition is met.

- Limit Order Status: If the order cannot be filled at the set price, it becomes a limit order, which will be automatically executed if the conditions are met.

Benefits of Using Limit Orders on Bitfinex

- Increased Profits: By limiting losses and locking in profits, traders can significantly increase their overall profits.

- Reduced Losses: Limit orders help traders avoid significant losses due to market volatility or unexpected price movements.

- Flexibility: Limit orders provide traders with the flexibility to adjust their positions based on changing market conditions.

Conclusion

Limit orders are a valuable trading strategy that can be used effectively in combination with Bitfinex’s crypto trading signals system. By setting specific price levels and adjusting to market conditions, traders can maximize their profits while minimizing their losses. Whether you are an experienced trader or just starting out, the world of Bitfinex limit orders is definitely worth considering.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Always do your own research and consult a financial advisor before making any trading decisions.